The Brazilian sports betting and online gaming market is moving towards regulation from January 1, 2025. Claudio Akio Namikata Jr., Head of Product at PayBrokers, prepared an analysis aiming to offer guidelines for players in the sector. Furthermore, he detailed the ordinances published so far by the Union.

Check out the text by Claudio Akio Namikata Jr., from PayBrokers, in full:

Observing the growing demand from PayBrokers customers and the federal requirement for operators to comply with the requirements of the new ordinances already published by the Secretariat of Prizes and Bets of the Ministry of Finance (SPA/MF) by January 1, 2025, I decided to write this article for clarity and guidance. Here, I highlight the points of the three Brazilian regulatory ordinances from a priority and product perspective.

Before discussing the product requirements, I first address the basic legal and mandatory conditions for betting operators, based on normative ordinances SPA/MF nº 827, which establishes the rules and conditions for obtaining authorization for the commercial exploitation of lottery betting games. fixed quota by private economic agents in Brazil; of SPA/MF nº 722, with technical and security requirements for betting systems and their platforms, including sports betting and online games, to be used by fixed odds betting lottery operators; and SPA/MF nº 615, which provides general guidelines for payment transactions carried out by agents authorized to operate the fixed-odd betting lottery.

For operators wishing to operate in the Brazilian market, it will be necessary to send authorization requests by August 20th. The authorization will be exclusive to legal entities that have received prior approval from the Prizes and Betting Secretariat (SPA) of the Ministry of Finance to operate as betting operators.

Among a series of other factors, it will also be necessary to follow various technical and governance requirements, as well as proving, from registration in the National Register of Legal Entities (CNPJ) with a Brazilian partner holding at least 20% of the share capital, to issues such as the integrity of the company, which must also undergo economic and financial qualification.

Within this last topic, it is worth highlighting that operators will be required to have a minimum financial reserve of R$5 million and a minimum net worth of R$30 million, in addition to proof of paid-in share capital of at least R$30 million for a 5-hour license. years to operate up to 3 brands. In total, at least R$35 million is needed to be able to operate in the national territory (since the net equity and paid-in share capital can overlap).

After explaining the main tests that must be carried out by operators, I highlight some of the general requirements of the platform system that we must also try to meet.

These include: control programs to manage and monitor the overall operation of the system; authentication mechanisms to verify the identity of users and prevent unauthorized access, such as multi-factor authentication and designed to detect and respond to suspicious login attempts; and clear confirmation or denial of all transactions carried out by bettors with immediate feedback on the status of their betting activities and financial transactions.

Betting account

Another topic worth highlighting refers to betting accounts. This is because all deposits and withdrawals of resources by bettors must be made exclusively via electronic transfer between a registered account of the bettor and a transactional account of the betting operator.

Both must be kept in financial institutions authorized by the Central Bank of Brazil. At this point, I highlight that it is prohibited for unauthorized institutions to act as intermediaries in payment transactions between the bettor and the betting operator, including through collection agents or payment managers.

Before understanding how to manage and transact the different accounts provided for by law, let’s look at account registration for bettors, where they must complete a registration process to create a betting account. The personal information necessary to verify the bettor’s identity must be made available here.

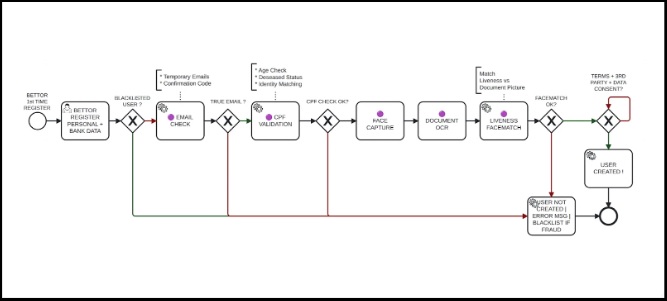

It is a simple process – which includes many of the written requirements of SPA/MF Normative Ordinance nº 722 –, in which I try to unravel KYC components – for identity verification, marked in purple dots in the art below –, showing possible places to insert services that third-party KYC providers may offer that may further affect the final cost of the payment transactional structure.

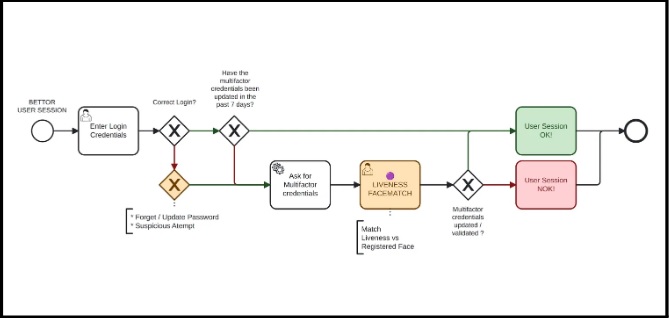

At the account verification stage, the betting operator must verify the accuracy of the information provided by the bettor during registration (identity, age and location of the bettor by various means). It is important to note that multifactor credentials must be updated at least every 7 days. You can use methods such as email code checks, but for password updates, forgotten password cases or suspicious login attempts (marked in yellow in the figure below), facematch verification must be used.

Moving on to the bettor’s operations in their respective betting accounts, deposits can be made using approved payment methods, such as electronic bank transfers or by PayBrokers, through Pix. The system must ensure that all deposits are accurately credited to the bettor’s account, which must receive a record of all funding transactions.

I also highlight that betting operators are also prohibited from accepting financial deposits through: bank slips, checks, virtual assets, cryptocurrencies, payments or transfers from unregistered accounts, payments or transfers from third parties, credit cards and post-payment instruments. paid. That’s why at PayBrokers we use Pix.

Once an account is funded, bettors can place bets on various sporting events or casino games offered by the operator. The system must accurately record and send to the player all bets placed, including event details, odds and bet amount. In this context, players must have access to detailed account statements showing all transactions, including deposits, bets, wins, losses and withdrawals. These vouchers must be available for a specific period as required by regulations.

How to transact and manage accounts

Entering the part where I talk about the relationship between the different accounts that must be created, I begin by highlighting that betting operators are prohibited from using bettors’ resources held in transactional accounts, even temporarily, to cover prizes owed or any other expenses. responsibility of the betting operator.

The operator is not permitted to use the funds in the transactional account, even temporarily, for any purpose other than paying prizes to winning bettors. They are also prohibited from sharing any earnings from investing transactional account balances with bettors.

In addition to the transactional account, there are two other types of account. One of them is the proprietary account, for deposit or prepaid payment owned and operated freely by the betting operator. It is used to cover the betting operator’s operational expenses and liquidity management. The funds in the proprietary account belong to the betting operator and can be used for their own purposes. After paying winnings to bettors, the operator can transfer his own winnings from the transactional account to this proprietary account.

The other is the reserve account, which consists of a preventive measure to guarantee the payment of prizes and other amounts owed to bettors in the event of insolvency or lack of liquidity of the betting operator.

It must be kept separately from the betting operator’s transactional and proprietary accounts, and must also have a minimum balance of R$5 million maintained in federal public bonds registered in the SELIC system. The reserve account balance may only be moved by the betting operator after other sources of contingency financing have been exhausted and with prior authorization from the Prizes and Betting Secretariat of the Ministry of Finance.

Having explained the types of accounts, I highlight that, to transact and manage them, system requirements must be observed, such as:

- Betting operators must implement liquidity risk management policies that establish objective exposure limits proportional to the operator’s assets; provide processes to measure, monitor and mitigate exposure to liquidity risk over different time horizons, including intraday, containing a contingency plan detailing additional sources of funds, responsibilities and procedures for dealing with liquidity stress situations;

- The liquidity risk management policy must be approved and reviewed at least annually by the betting operator’s management;

- Betting operators must maintain sufficient funds in their proprietary accounts to cover operating expenses and exposure limits.

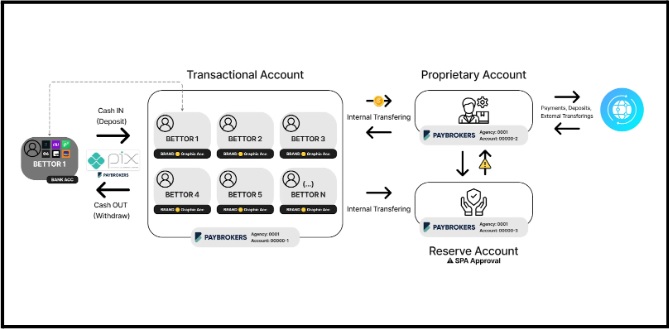

As shown in the image above, from left to right, I explain the process in simple terms. For PayBrokers to make Cash in (deposit) and Out (withdrawals), we will mainly need the bettor’s Pix key. However, for the operator on the platform it is mandatory to have registered the bettor’s validated bank account (Bank + Agency + Account).

In the illustrative drawing, as each operator will have up to 3 brands, I considered the green, yellow and purple dots when representing that the transactional account will have the consolidated balance of all bettors, in all their graphic user accounts of the brands.

Another observation is that, as all operations related to bets and prizes will be in the transactional account, it can be considered that the proprietary account will be the account from which the operator will receive his winnings and pay his “bills”.

Finally, I highlight that the reserve account is similar to a “savings account” that earns interest through SELIC bonds, probably used by operators only as a last resort, only with approval from the SPA.